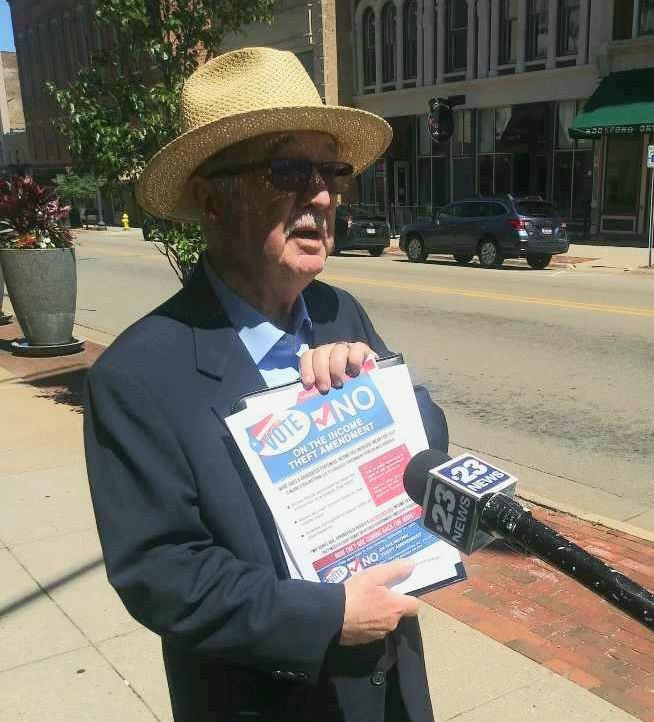

Illinois State Police blocked a Taxpayers United of America (TUA) news conference at the Illinois State Capitol from taking place on Monday, Sept. 15, 2020, reports Jim Tobin, economist and TUA president.

“We have been issuing analyses of state government pensions for 14 years,” said Tobin, “and TUA Executive Director Matt Schultz and I traveled from Chicago to Springfield to report on the lavish, gold-plated government pensions as they affect Sangamon County, which has some of the highest taxes in the country.”

“I had reserved a block of time at the state capitol press room, which I have been doing for 44 years. When we arrived at the state capitol building, members of the Illinois State Police blocked us from walking to the press room. They claimed they didn’t know who we were, and that they could not let us proceed ‘without authorization.’ After some time had passed, some woman arrived thinking we were part of another group. Finding out that we were not, she left without authorizing our move to the press room.”

“Finally, after about 30 minutes, we made it to the capitol press room and found it completely deserted.”

“Whether our being blocked was intentional or due to sheer incompetence, the effect was the same. We were unable to discuss the Sangamon County pensions or Illinois Gov. Jay Robert ‘J. B.’ Pritzker’s income theft amendment that has been placed by Democrats on the November 3 ballot. This amendment to the State Constitution would significantly raise taxes on Illinois taxpayers by converting the flat-rate state income tax to a graduated income tax.”

“I have been holding news conferences at the state capitol press room for 44 years, and never have I been blocked from holding a news conference until yesterday. What happened was outrageous and unconscionable, and we are owed an apology from Gov. Pritzker and Illinois House Speaker Michael J. Madigan, but I am not holding my breath.”