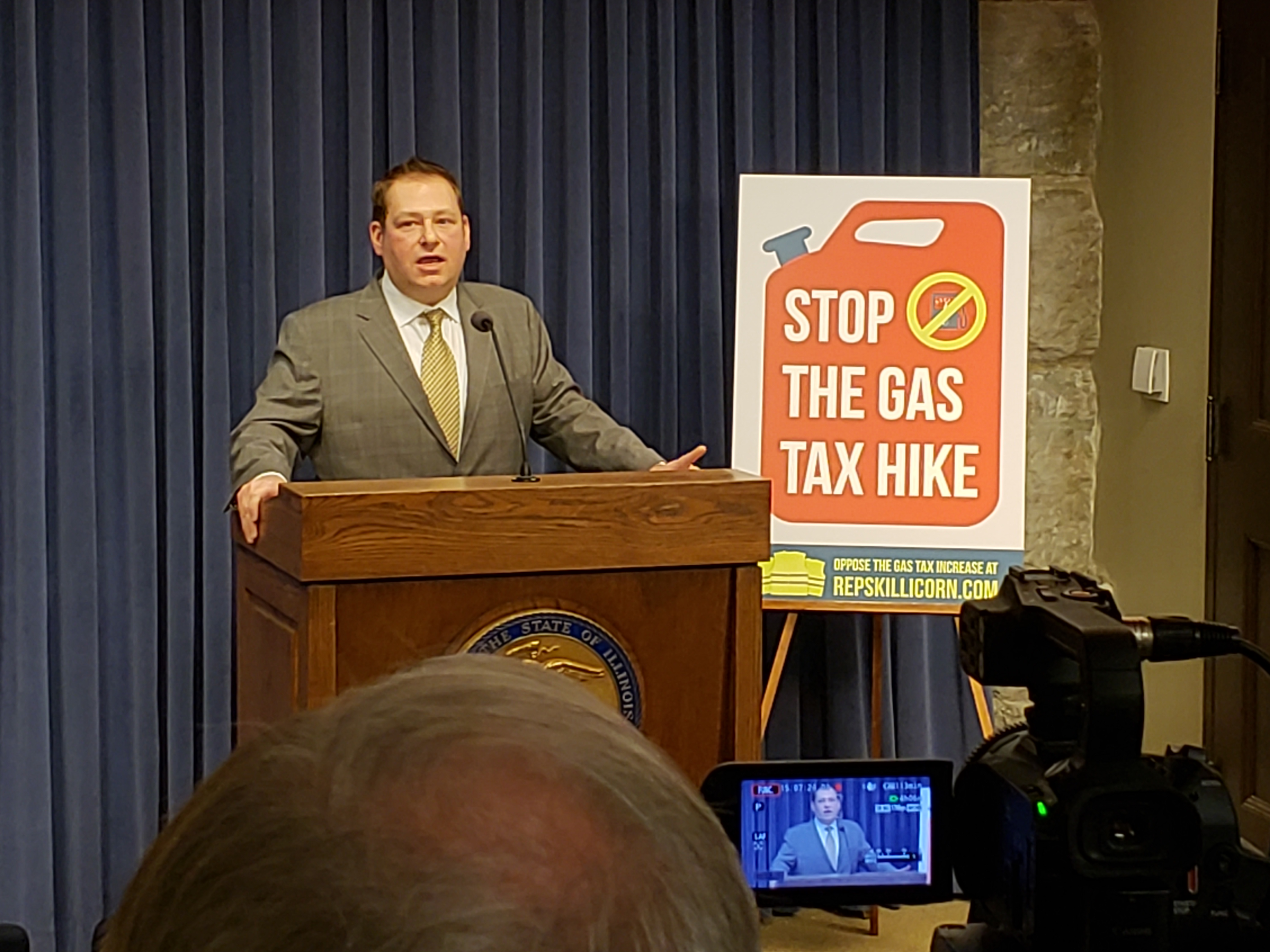

CHICAGO—Taxpayers United of America (TUA) enthusiastically supports the proposal of St. Rep. Allen Skillicorn (R-66, Crystal Lake) to repeal the current gasoline tax hike and infrastructure improvement bill, said Jim Tobin, president of TUA.

“I agree that legislators should start over in light of the FBI investigation into Sen. Martin Sandoval (D-11, Cicero), the architect of the recent massive gas tax increase and corrupt enabler of House Speaker Michael J. Madigan (D-22, Chicago).”

Sen. Sandoval shares political turf with disgraced Chicago Alderman Ed Burke and House Speaker Madigan.

“Federal investigators raided Sen. Sandoval’s house and offices, and there are questions about potential kickbacks. We have no assurances that anything about his bill was above board.”

The $45 billion spending plan calls for $20.6 billion in new borrowing and tax increases, including doubling the motor fuel tax. According to the Civic Federation, the Capital plan signed into law showed “no evidence of comprehensive planning to prioritize projects.”

“I agree with Rep. Skillicorn that the legislature should repeal it and draft clean legislation to provide taxpayers with a guarantee that their hard-earned dollars are not going to pad the pockets of connected insiders.”