View as PDF

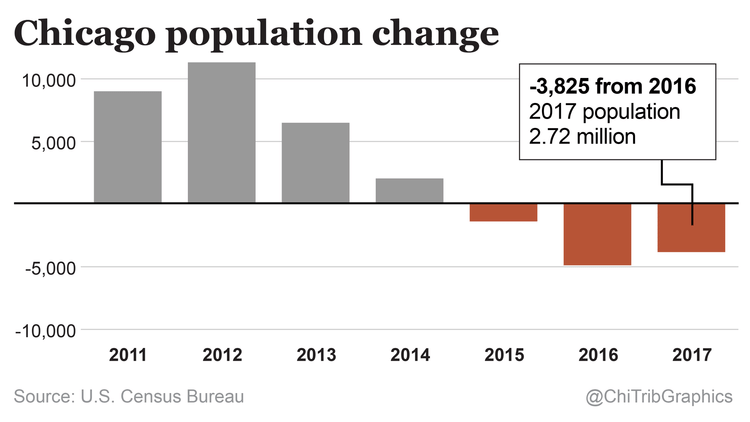

CHICAGO—A recent Chicago Tribune article called attention to Chicago’s having lost 3,825 residents last year and 4,879 residents in 2016, and to the fact that Chicago metropolitan area lost residents for three consecutive years.

CHICAGO—A recent Chicago Tribune article called attention to Chicago’s having lost 3,825 residents last year and 4,879 residents in 2016, and to the fact that Chicago metropolitan area lost residents for three consecutive years.

Illinois dropped from fifth-most populous state to sixth-most populous state in 2017.

The article, Chicago population still tops Houston’s, described the population losses as a “trickle,” and added that “experts are trying to figure out why,” noted Jim Tobin, president of Taxpayers United of America, headquartered in Chicago.

“I can tell you why, and so can everyone other than the Tribune. Two reasons: the city’s and state’s high taxes, forcing taxpayers to flee to states with lower taxes, and the realization that the City of Chicago and State of Illinois are bankrupt and that both will go under in the not-too-distant future.”

“The lavish, gold-plated pensions of retired Chicago and state government-employees are rapidly drying-up their pension funds. Here are some facts regarding the Tribune’s host city.”

“All of the top 200 Chicago pensions for its ‘civil servants’ are at least $100,000 a year,” said Tobin. “The average retirement age for this group of pensioners is only 58. Social Security requires taxpayers to reach age 67 to be eligible for full retirement benefits, which average only about $17,000 a year.”

“I would like to inform the Tribune that the Municipal Employees’ Annuity and Benefit Fund of Chicago, (MEABF) is predicted to be insolvent in 8 years, according to its most recent audit. The auditing firm estimated that taxpayers would have to deposit $1,005,456,621 to make the fund solvent. MEABF does not include Chicago teachers, police, or firefighters who each have their own pension system, all separate from the 6 statewide pension funds.”

“The state of Illinois also is bankrupt. It can’t pay its bills because the outrageously rich government pensions have robbed the taxpayers blind. And there won’t be a bailout by the state for the city of Chicago – there just isn’t enough taxpayer money, no matter how high taxes are raised.”

“We support the plan by independent gubernatorial candidate William “Dock” Walls to repeal the back-breaking Illinois state income tax.”

View as PDF

Chicago – North side residents drown from higher property taxes as The Illinois Pension Crisis worsens.

Already burdened by some of the highest property taxes in the country, Chicago communities such as Lakeview are seeing their property taxes soar after recent property tax assessments. The average increase in Lakeview alone is 32 percent, and increases as high as 50 percent have been reported. Combined with other tax increases, including another property tax increase pushed by the Mayor of Chicago, the situation is going from bad to worse.

As reported on by the Chicago Tribune, the greedy City of Chicago will be hiking taxes on property, water and sewer. There will also be increased fares for the CTA and increased monthly fees for 911. The Chicago Turbine has finally identified the cause of these tax increases, Illinois pensions.

“The vast bulk of the money raised will be spent on fixing underfunded government worker pension systems that were at risk of going broke. It’s a point Mayor Rahm Emanuel often raises, also noting that he’s trying to end the practice of papering over Chicago’s longstanding financial woes accrued under former Mayor Richard M. Daley. That, however, may be cold comfort to taxpayers now shouldering the burden.”

The state of Illinois pension system has been a burden on taxpayers for years. A recent example of the Illinois Pension Crisis was Harvey Illinois. It was reported that due to pensions, Harvey Illinois was forced to lay off a quarter of the police force and almost half of their fire fighters to pay lavish pensions.

Below are just some of the pensions the citizens of Chicago are forced to pay.

|

Chicago Municipal Retirees |

|||

|

Top 5 Pensions as of 2017 |

|||

| Name | Current Annual Pension | Age at Retirement | *Estimated lifetime payout |

| DENNIS GANNON | $194,638 | 50 | $7,791,985 |

| STEPHEN MURRAY | $146,896 | 53 | $5,107,745 |

| KATHRYN NELSON | $142,333 | 54 | $4,713,837 |

| TERESITA SAGUN | $141,231 | 57 | $3,364,221 |

| EDWARD BEDORE | $139,080 | 56 | $3,009,775 |

Click here for the Chicago municipal retirees top 200 Pensions

“All of the top 200 Chicago pensions for the ‘poor civil servants’ are at least $100,000 a year,” stated TUA’s president, Jim Tobin. “The average retirement age for this group of pensioners is only 58. Social Security requires taxpayers to reach age 67 before they are eligible for full retirement benefits…which max out at about $32,000 a year”

View as PDF

CHICAGO—The president of Taxpayers United of America (TUA) today condemned the recommendation released May 13 under the letterhead of the Federal Reserve Bank of Chicago to introduce a statewide 1% property tax to bail out the floundering government-employee pension plans in the state.

“This recommendation is not only astounding, it’s irresponsible,” said Jim Tobin, TUA president, economist and former Federal Reserve auditor.

“Illinois taxpayers already are heavily subsidizing the lavish, gold-plated pension plans of retired government employees. The $5 billion generated by the latest state income tax increase is being poured into the black hole of the state pension funds, and still the funds are essentially insolvent.”

“It’s impossible for the state to tax its way out of this mess, but tax thieves still propose new and higher taxes for Illinois taxpayers. More taxpayers have fled Illinois than any other state, but this doesn’t seem to register with tax-and-spend politicians.”

“The reasons given for this recommendation are pathetic. Because homeowners purportedly have benefited most from government ‘services,’ say the three authors of this proposal, they should pay a larger share of the costs of bailing out the state pension plans. In other words, they say the most successful people in the private sector should pay more to support these extravagant pension plans.”

“Illinois is bankrupt in fact, if not in name, and the only way to keep the state from going under is to place a state constitutional amendment on the statewide ballot to allow reductions in these pension benefits. All new government hires should be put into their own 401(k) accounts, and current retirees must greatly increase their contributions to their pension plans.”

“A statewide 1% property tax would devastate the already-feeble Illinois economy, and accelerate the departure of the middle class from Illinois.”