View as PDF

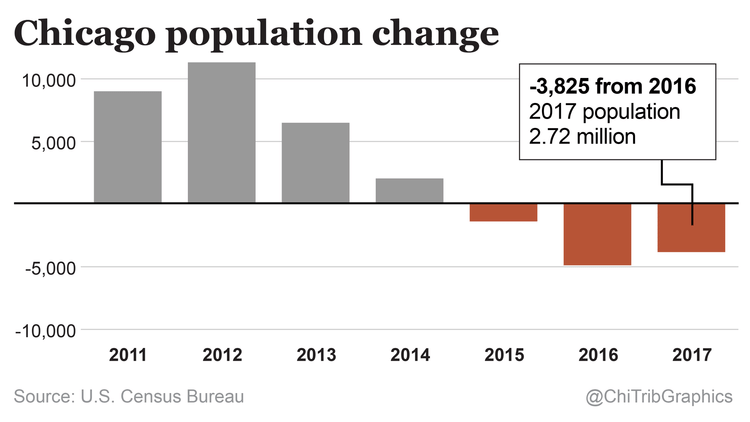

CHICAGO—A recent Chicago Tribune article called attention to Chicago’s having lost 3,825 residents last year and 4,879 residents in 2016, and to the fact that Chicago metropolitan area lost residents for three consecutive years.

CHICAGO—A recent Chicago Tribune article called attention to Chicago’s having lost 3,825 residents last year and 4,879 residents in 2016, and to the fact that Chicago metropolitan area lost residents for three consecutive years.

Illinois dropped from fifth-most populous state to sixth-most populous state in 2017.

The article, Chicago population still tops Houston’s, described the population losses as a “trickle,” and added that “experts are trying to figure out why,” noted Jim Tobin, president of Taxpayers United of America, headquartered in Chicago.

“I can tell you why, and so can everyone other than the Tribune. Two reasons: the city’s and state’s high taxes, forcing taxpayers to flee to states with lower taxes, and the realization that the City of Chicago and State of Illinois are bankrupt and that both will go under in the not-too-distant future.”

“The lavish, gold-plated pensions of retired Chicago and state government-employees are rapidly drying-up their pension funds. Here are some facts regarding the Tribune’s host city.”

“All of the top 200 Chicago pensions for its ‘civil servants’ are at least $100,000 a year,” said Tobin. “The average retirement age for this group of pensioners is only 58. Social Security requires taxpayers to reach age 67 to be eligible for full retirement benefits, which average only about $17,000 a year.”

“I would like to inform the Tribune that the Municipal Employees’ Annuity and Benefit Fund of Chicago, (MEABF) is predicted to be insolvent in 8 years, according to its most recent audit. The auditing firm estimated that taxpayers would have to deposit $1,005,456,621 to make the fund solvent. MEABF does not include Chicago teachers, police, or firefighters who each have their own pension system, all separate from the 6 statewide pension funds.”

“The state of Illinois also is bankrupt. It can’t pay its bills because the outrageously rich government pensions have robbed the taxpayers blind. And there won’t be a bailout by the state for the city of Chicago – there just isn’t enough taxpayer money, no matter how high taxes are raised.”

“We support the plan by independent gubernatorial candidate William “Dock” Walls to repeal the back-breaking Illinois state income tax.”

View as PDF

CHICAGO—The president of Taxpayers United of America (TUA) today condemned the recommendation released May 13 under the letterhead of the Federal Reserve Bank of Chicago to introduce a statewide 1% property tax to bail out the floundering government-employee pension plans in the state.

“This recommendation is not only astounding, it’s irresponsible,” said Jim Tobin, TUA president, economist and former Federal Reserve auditor.

“Illinois taxpayers already are heavily subsidizing the lavish, gold-plated pension plans of retired government employees. The $5 billion generated by the latest state income tax increase is being poured into the black hole of the state pension funds, and still the funds are essentially insolvent.”

“It’s impossible for the state to tax its way out of this mess, but tax thieves still propose new and higher taxes for Illinois taxpayers. More taxpayers have fled Illinois than any other state, but this doesn’t seem to register with tax-and-spend politicians.”

“The reasons given for this recommendation are pathetic. Because homeowners purportedly have benefited most from government ‘services,’ say the three authors of this proposal, they should pay a larger share of the costs of bailing out the state pension plans. In other words, they say the most successful people in the private sector should pay more to support these extravagant pension plans.”

“Illinois is bankrupt in fact, if not in name, and the only way to keep the state from going under is to place a state constitutional amendment on the statewide ballot to allow reductions in these pension benefits. All new government hires should be put into their own 401(k) accounts, and current retirees must greatly increase their contributions to their pension plans.”

“A statewide 1% property tax would devastate the already-feeble Illinois economy, and accelerate the departure of the middle class from Illinois.”

View as PDF

CHICAGO—The Chairman of the Illinois Revenue & Finance Committee, Democrat hack and Madigan puppet, Michael J. Zalewski (D-23, Riverside), refused to allow TUA Director of Outreach, Val Zimnicki, to testify against the proposed state Income Tax Increase Amendment at a Chicago hearing on Wednesday, May 2. This bill, HR 1025, filed by Ill. House Speaker and Chicago machine boss Michael J. Madigan (D-22, Chicago) calls for a graduated state income tax increase for Illinois.

Zimnicki was registered to be among those giving oral testimony in opposition to this state tax increase.

Over 2150 witness slips had been filed to present oral testimony, written testimony, or have record of appearance in opposition to this huge state tax increase.

Zalewski allowed only supporters of the bill to testify before the committee. No speakers opposed to the income tax increase were able to testify, and Zimnicki initially was informed that he was not on the list to testify. After further questioning, it was revealed that he was indeed on the list, but was not given a date and time. It was stated that if TUA was to be heard, it would likely be in Springfield, IL, a 200-mile trip from the May 2 meeting in Chicago.

Zalewski also is a chief co-sponsor of HR 1025. This abuse of power occurred with the support of notorious Taxpayer Traitor David Harris (R-53, Mt. Prospect), who was the Republican Spokesperson for the Committee and who voted to raise the Illinois State Income Tax by $5 Billion dollars.

Despite this silencing of Taxpayers, TUA will continue to spread its message of opposition to higher taxes to fund lavish, gold plated pensions for retired government employees. The Director of Outreach’s written statement can be found below.

“Honorable Chair, and members of the Revenue and Finance Committee, I am Val Zimnicki, Director of Outreach for Taxpayers United of America.

As I look down the road toward retirement, I am struck by how unfair the current Illinois pension system is to the middle class.

As someone who works in the private sector, the most retirement income I can look forward to is about $17,000, from Social Security—if I am lucky to get that much.

In contrast, retired government employees receive lavish, gold-plated retirement benefits, and, as an Illinois taxpayer, I am forced to pay for these benefits through the state income tax.

The current, unsustainable state pension system has created many pension millionaires among retired government employees.

Former Illinois Governor Jim Edgar (R), no friend of taxpayers, is rolling in money, thanks to these Illinois government-employee pension plans. Mr. Edgar gets an Illinois General Assembly pension of $166,000 per year, a State University Retirement System pension of $83,000 per year, and is currently hired-back “part-time” by the University of Illinois for another $62,796 per year—pulling in more than $312,000 per year.

Former Governor Edgar is a pension millionaire. Former Governor Quinn (D) is a pension millionaire. Former Governor Thompson (R) is a pension millionaire. These three so-called ‘public servants’ are going to receive a total of $11,388,000 in pension payouts over their expected lifetimes.

I am paying for their extravagant retirements, because most of the money from the recent state income tax increase is being poured into the insolvent state pension funds that send monthly checks to them.

The State of Illinois is functionally bankrupt, and government-employee pensions are to blame.

Illinois taxpayers are voting with their feet. In 2017, the number of people moving from Illinois to states with lower taxes outstripped arrivals by 115,000. And it will get a lot uglier if the proposed state Income Tax Increase Amendment is passed.

If the state income tax, now a flat tax, is converted to a graduated state income tax, the exodus from Illinois by the middle class will become a stampede. The state will literally go under financially.

It is impossible for the state to tax itself out of its current downward spiral. There is not enough money to go around to pay for its current unfunded pension liabilities of more than $130,000 billion.

There is a solution, and it also involves a state constitutional amendment. The current Constitution must be amended to allow for reasonable decreases in pension benefits for retired government employees.

In addition, all new government hires must be placed in 401(k)-style pension plans, so there will be no increases in the current unfunded pension liabilities.

Thank you for your attention.”