Taxpayers United of America’s president, Jim Tobin, wrote a letter urging people to contact State Rep Barbara Wheeler that was featured in McHenry County Blog.

Mailed First Class last week, the envelop below arrived in my mailbox and those of 229 other people on Jim Tobin’s mailing list two days later:

The envelop from Jim Tobin features the message on its face–a good communications’ technique.

It was addressed to me and attacks State Rep. Barbara Wheeler, who does not have an opponent in the Republican Primary election or in the General Election.

Here’s the content after the individualized salutation:

Barbara Wheeler

While Illinois is absolutely in desperate need of government pension reform, the legality of singling out only government pensions for a new state income tax is highly questionable, due in part to legal precedents set by the Illinois Supreme Court last May, but also, the Illinois Constitution and United States Constitution both have a Uniformity Clause expressly stating that taxes are to be levied uniformly.

Her proposal doesn’t hold water.

Although Wheeler is correct in seeking a legal maneuver to enact government pension reform, which is needed immediately in Illinois, her proposal is not constitutional.

This suggested legislation could instead lead to the Illinois General Assembly adopting an even worse option, which would be legal: imposing a new Illinois state income tax on all retirement benefits, including Social Security.

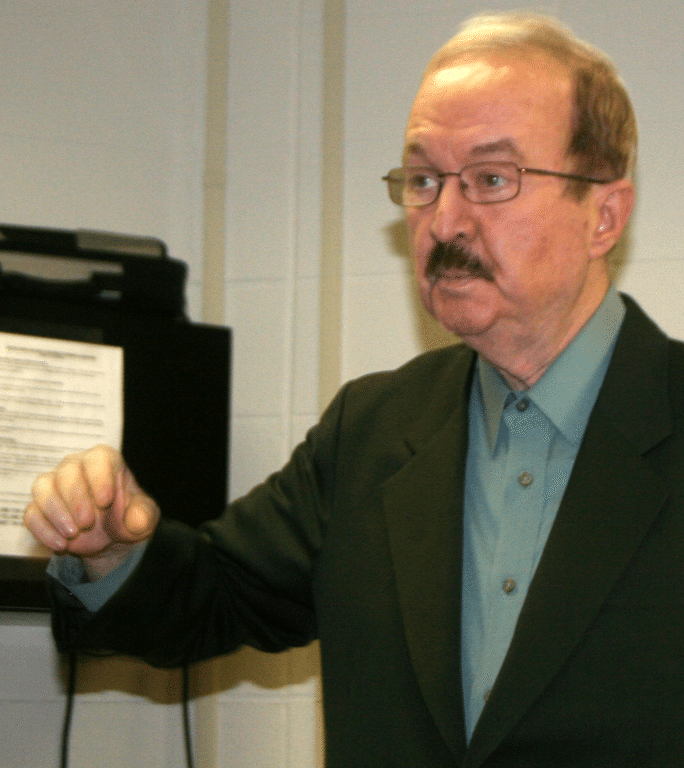

Jim Tobin in Crystal Lake

Please take a look at the enclosed government pension data. These lavish, multimillion dollar lifetime pension payouts for retired government employees give taxpayers millions of reasons as to why we must pursue constitutional means to enact government pension reform immediately.

Contact Illinois state representative Barbara Wheeler at her Crystal Lake office (847) 973-0064 or Springfield office (217) 782-1664 and let her know that taxpayers will not support a new state income tax.

Nearly 90% of the funds from the last state income tax hike went to fund the uncontrolled government pensions, and the results were negligible, if not detrimental to the financial stability of our state.

We need free market solutions to return prosperity to Illinois – NOT NEW TAXES.

Sincerely,

Jim Tobin, President

P.S. Help us stop the Illinois General Assembly from imposing a new Illinois state income tax on all retirement benefits, including Social Security.