Click here to view the Taxpayer Education Foundation’s 12th annual pension study

Springfield – Taxpayers United of America (TUA) today released its updated study on Springfield, Illinois government employee pensions, publishing the top 200 pensions for Springfield and Sangamon County Illinois Municipal Retirement Fund (IMRF), the top 200 pensions of the Teachers’ Retirement Fund (TRS), and the top 200 pensions of State University Retirement System (SURS).

“Springfield and Sangamon County are in dire financial condition due to the funding of the government pensions throughout the county,” stated Jim Tobin, president of TUA.

“Springfield and Sangamon County have been increasing taxes at an unsustainable rate in order fund the unsustainable government pensions. Springfield increased its city sales tax by $0.25 and increased taxes on telecom services from 11% to 13% and Sangamon County has a property tax increase referendum on the 2018 ballot to increase Sales Taxes County wide.

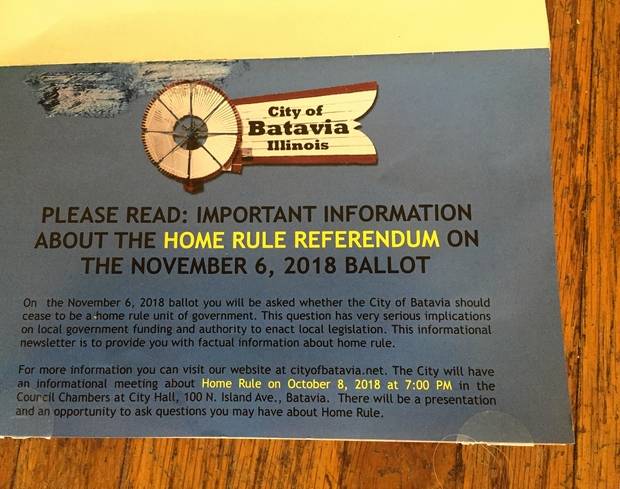

“Not only is the county seeking a sales tax increase but Mt. Pulaski also has a $10 million property tax increase referendum for Mt. Pulaski High School. The Village of Jerome is seeking an additional property tax increase specifically for IMRF payments. On top of this, Rochester Public Library District is also supporting a property tax increase referendum on November 6.

“While IMRF pensions are funded by property taxes, other taxes free up money so Springfield and every other municipality can use these revenues for services in order to free up money for the state mandated property tax deposits to the IMRF fund. Every year, the IMRF portion of the property tax bill increases leaving fewer resources available for the services required for taxpayers. In 2017, about 18% of Springfield property tax revenue collected went to government employee pensions. If not reigned in, Springfield will find itself like Galesburg which pays a colossal 67% of its property taxes towards unnecessary lavish government pensions.”

- Click here to see the top 200 Sangamon County TRS pensions

- Click here to see the top 200 Springfield and Sangamon County IMRF pensions

- Click here to see the top 200 Sangamon SURS pensions

“But J. B. Pritzker and House Speaker, Democrat Michael Madigan have plans to raise state income taxes if Pritzker wins the gubernatorial election on November 6,” added Tobin.

“Priztker advocates for an immediate income tax increase and also supports the Income Tax Increase Amendment, which would change the current flat-rate state income tax to a graduated state income tax. He and his buddy Madigan plan on placing the amendment on the November 2020 statewide ballot.”

“If the amendment passes, you can expect the state’s middle class to be decimated. Here’s why: House Bill 3522, filed by state Rep. Robert Martwick, D-Chicago, would tax incomes between $7,500 and $15,000 at 5.84 percent. For incomes between $15,000 and $225,000, the rate would be 6.27 percent. And for incomes over $225,000, the rate would be 7.65 percent. Some politicians are whispering about a maximum income tax rate as high as 9.85 percent,” added Tobin.

“The pension data speaks for itself. The average Sangamon County taxpayer’s Social Security pension is about $17,000 and is funded completely with private money from taxpayers and their employers.”

“IMRF pensioners collect Social Security on top of their very generous local government pensions so taxpayers are forced to shell out an additional 15% of the local government employee salaries.”

“TRS pensioner Michael D. Johnson enjoys a stunning $253,450 annual pension. He likely gets about $30,000 taxpayer funded Social Security on top of that. His TRS pension will accumulate to more than $9 million over a normal lifetime. This ‘poor civil servant’ retired at the ripe old age of 55 and he only paid little more than $310,000 into his own retirement.”

“Robert A. Alvey retired from Sangamon County Water Reclamation District with an annual pension of $152,415. He was 60 at retirement and only paid $103,555 into his own pension which will accumulate to about $3,656,771 over a normal lifetime.”

“Harry Berman retired from University of Illinois at Springfield with an annual pension of $176,906. Those annual pension payments will accumulate to about $4,036,350.”

“If Pritzker gets elected, he and Illinois tyrant Madigan will see to it that these pensions are subsidized by taxpayers. The pension promises bring in the thousands of union and government employee votes. Taxes will increase at a devastating rate and more and more Illinoisans will leave the state, driving up the tax burden for those of us who stay.”

“It is just unreasonable to allow people to retire in their 50’s and early 60’s and expect taxpayers to foot the bill, but if Madigan gets his way and Pritzker wins the governor’s race, government pension reform won’t occur anytime soon,” concluded Tobin.